How to Make Your First Million

Building real wealth has gotten complicated with all the gurus and advice flying around. As someone who’s studied millionaire habits and wealth-building strategies for years, I learned everything there is to know about hitting that seven-figure mark. Today, I will share it all with you.

Let me be upfront: making your first million isn’t about one lucky break. It’s strategy, discipline, and yeah, some patience. But it’s absolutely doable if you play it right.

Set Goals That Actually Mean Something

Start by figuring out your target and your timeline. Want a million by 45? By 55? Those are very different plans. Break the big number down into smaller milestones — they’re less overwhelming and way easier to track.

Have goals for right now, for the next few years, and for the long haul. Check in on them regularly and adjust when life throws curveballs. Because it will.

Know Exactly Where Your Money Goes

Probably should have led with this section, honestly. You can’t build wealth if you don’t know where your money disappears to every month. List every income source, track every expense, and sort them into needs vs. wants.

This isn’t about living like a monk — it’s about being intentional. A budget isn’t set-it-and-forget-it either. It should change as your income and priorities change.

Invest Like You Mean It

Investing is how you actually grow wealth. Saving alone won’t get you to a million (not unless you’ve got decades and a massive income). Get familiar with stocks, bonds, real estate, and mutual funds. Each one has a different risk and reward profile.

Diversify so you’re not putting all your eggs in one basket. If you’re not sure where to start, a financial advisor can help you build a strategy that fits your risk tolerance. And learn about compound interest and dollar-cost averaging — those two concepts alone can change your trajectory.

Don’t Rely on Just One Paycheck

A single income stream puts a ceiling on your potential. Side hustles, freelance work, small business ventures — they all add up. The gig economy makes it easier than ever to monetize skills you already have.

Passive income is the real game-changer, though. Dividends, rental income, royalties — money that comes in while you sleep. That’s what makes building multiple income streams endearing to us wealth builders — it accelerates everything.

Let Compound Interest Do the Heavy Lifting

Compounding is honestly the closest thing to magic in finance. The earlier you start, the more time your money has to grow on top of itself. Even modest regular investments can turn into something substantial over 20 or 30 years.

This applies to skills too. Every new thing you learn can increase your earning potential, which feeds right back into the wealth-building cycle.

Make Saving Automatic

Don’t wait until the end of the month to see what’s left over. Pay yourself first. Set up automatic transfers to a high-yield savings account. When saving happens before you can spend, it actually works.

And build an emergency fund — three to six months of living expenses. This keeps you from having to raid your investments when something unexpected hits.

Keep Your Spending in Check

This is where a lot of people trip up. As your income grows, your spending doesn’t need to grow with it. Lifestyle inflation is a wealth killer. That raise or bonus? Invest it instead of upgrading your car.

Negotiate your bills, look for cheaper alternatives, and be honest about what you actually need versus what you just want. Small savings compound just like investments do.

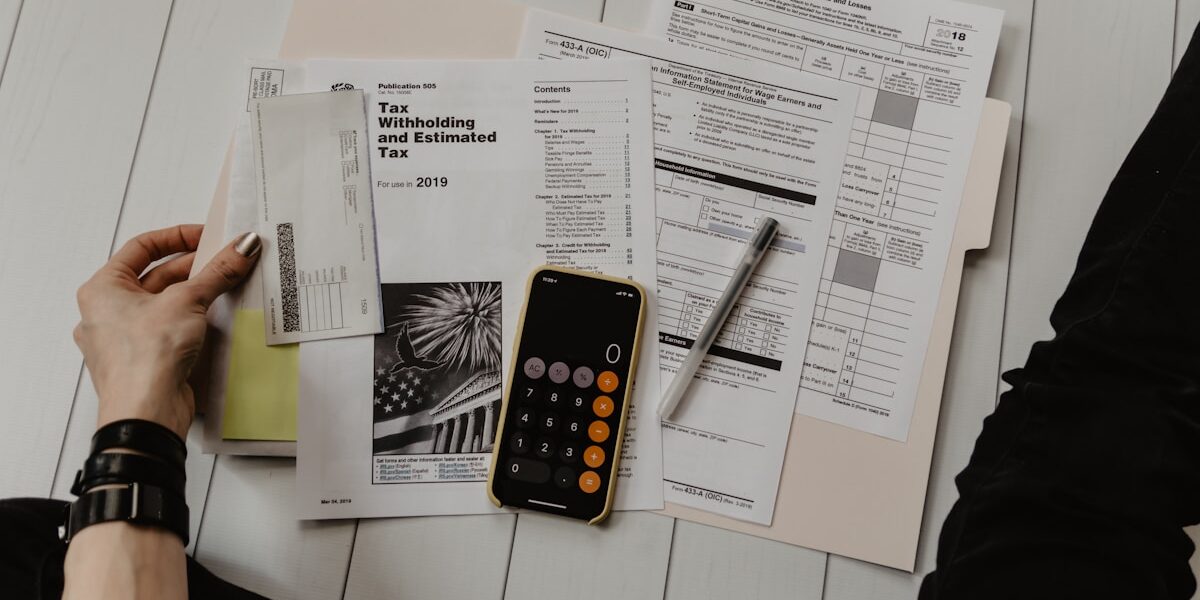

Use Tax-Advantaged Accounts

401(k)s, IRAs, HSAs — these accounts come with tax benefits that can save you a lot of money over time. Max them out if you can.

A good tax professional can help you find deductions and credits you’re missing. Every dollar you save on taxes is a dollar that can go toward your million.

Build Relationships with Smart People

Your network matters more than most people realize. Connect with folks who think about money the same way you do. Networking can lead to opportunities, partnerships, and insights you’d never find on your own.

Find a mentor who’s already where you want to be. Their experience can help you dodge mistakes and take shortcuts that would take years to discover otherwise.

Never Stop Learning

Stay current on financial trends, new investment opportunities, and what’s happening in the economy. Books, courses, podcasts, seminars — absorb it all.

But it’s not just financial knowledge. Discipline, perseverance, and a growth mindset are skills too. Work on those alongside the money stuff and you’ll be in much better shape.

Use Technology to Your Advantage

There are apps and platforms for everything now — budgeting, investing, tax planning. Use them. They make managing your finances faster and easier.

Keep an eye on emerging opportunities too, like blockchain and crypto. Just make sure you actually understand what you’re getting into before throwing money at it. The risks are real.

Avoid the Traps

High-interest debt is a wealth destroyer. Credit cards, payday loans — eliminate that stuff as fast as possible. Every dollar going to interest is a dollar not building your future.

And please, skip the get-rich-quick schemes. They almost always lead to losses. Patience and consistency beat flashy promises every single time.

Check In and Adjust

Review your financial plan regularly. What worked last year might not work this year. Be willing to shift strategies based on how things are going and what’s changed in your life.

Flexibility is a strength here. Markets change, opportunities pop up, risks evolve. Staying nimble keeps you moving forward.

Commit to the Long Game

Making your first million is a marathon. Consistent saving, smart investing, and disciplined spending build the foundation. There will be setbacks — market downturns, unexpected expenses, moments of doubt.

Stay the course. The people who hit seven figures aren’t the ones who found a shortcut. They’re the ones who showed up, stuck to their plan, and kept going when it wasn’t fun anymore. You can be one of them.

Stay in the loop

Get the latest wildlife research and conservation news delivered to your inbox.