Stealth Wealth: The Philosophy of Hidden Prosperity

Stealth wealth is an intriguing concept of understated affluence. It involves being wealthy without displaying obvious signs of wealth. This philosophy promotes financial security and personal humility.

The Origins of Stealth Wealth

Stealth wealth comes from the idea of living below one’s means. This idea has taken root in cultures that value modesty over opulence. Historically, showing off wealth wasn’t always safe. Opulence invited risks like theft, jealousy, and even political strife.

Today, some wealthy individuals adopt this approach to avoid the trappings of materialism. They choose a lifestyle that doesn’t scream money. This behavior can be observed in various societies and economic classes.

Principles of Stealth Wealth

Those who practice stealth wealth adhere to certain principles. These can be boiled down to a few key behaviors:

- Frugality: They spend less than they earn, regardless of how much they make.

- Privacy: They avoid disclosing their financial status.

- Simplicity: They prefer quality over quantity, often valuing experiences over possessions.

- Investment: They invest wisely and think long-term.

- Humility: They demonstrate their wealth through actions and values, not possessions.

Benefits of Stealth Wealth

Opting for a stealth wealth lifestyle has several benefits:

- Reduced Stress: Less focus on materialism decreases financial stress.

- Increased Security: Lower visibility of wealth reduces the risk of becoming a target of crime.

- Better Relationships: Relationships based on genuine connections rather than financial means.

- Financial Independence: More resources are available for investments and savings.

These benefits contribute to a more balanced, content, and secure life.

Stealth Wealth in Practice

Implementing stealth wealth involves practical steps. One of the most significant is monitoring spending habits. Instead of splurging on luxury items, practitioners allocate funds toward savings and investments.

Another step is blending in rather than standing out. This might mean choosing reliable mid-range cars instead of luxury models. Clothing choices also reflect this principle: simple and functional attire rather than designer brands.

Vacations are another area where this philosophy applies. Instead of high-profile destinations, they choose less-publicized travel spots. These trips can be rich in experience without the hefty price tag.

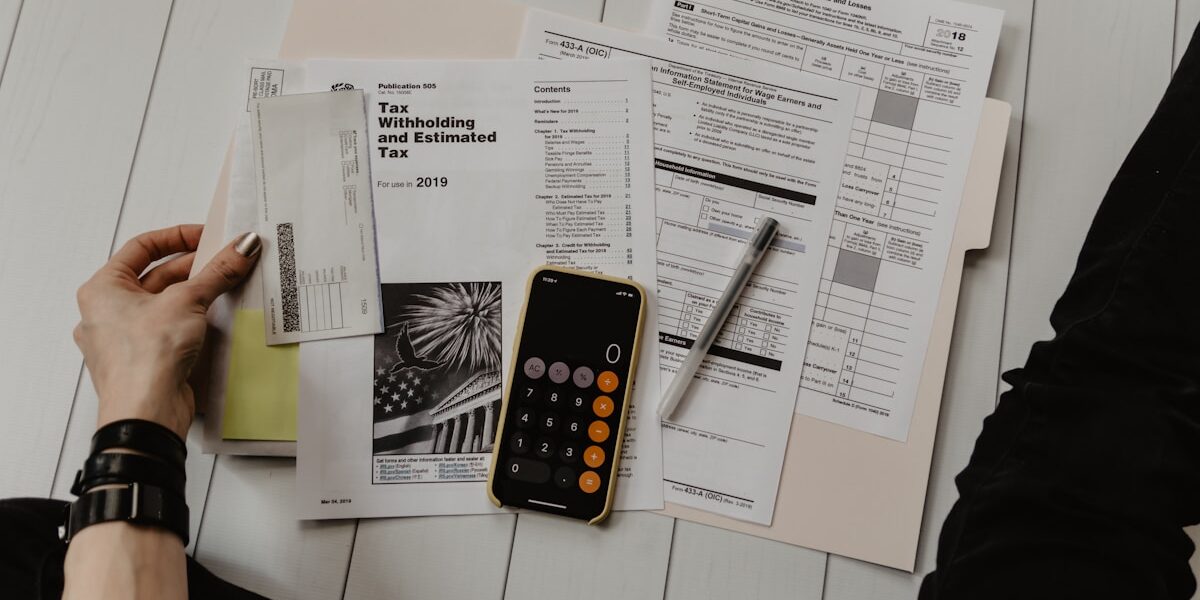

Financial Management and Investment

Investment strategies play a critical role in stealth wealth. Focusing on diverse portfolios and long-term gains, practitioners often prioritize assets like real estate, stocks, and bonds. Reinvestment of profits further enhances their financial growth.

Moreover, effective tax planning and charitable contributions are common. They reduce tax liabilities and support community welfare, reflecting values of responsibility and generosity.

The Psychology Behind Stealth Wealth

The motivation for stealth wealth often stems from a desire for genuine security and happiness. Material possessions offer temporary satisfaction. Emotional well-being comes from financial freedom and non-materialistic goals.

Practitioners are often driven by intrinsic values. They prioritize family, knowledge, and personal development over external validation. This mindset helps maintain a balanced approach to wealth and lifestyle choices.

Stealth Wealth in Public Figures

Some public figures exemplify stealth wealth. Warren Buffett is a renowned example. Despite his immense fortune, Buffett lives in a modest house and drives a sensible car. He’s known for his frugality and smart investments rather than extravagant spending.

Another example is Ingvar Kamprad, the founder of IKEA. Kamprad lived a life of intentional simplicity. His frugal habits were evident even as he built one of the world’s largest retailers. These figures demonstrate that wealth does not necessitate flashy lifestyles.

Everyday Stealth Wealth Practices

Individuals can adopt stealth wealth in daily life through practical measures:

- Adopting a budget: Keeping track of income and expenses to ensure frugality.

- Avoiding debt: Stressing the importance of living within one’s means.

- Investing in education: Prioritizing learning and self-improvement over material goods.

- Embracing minimalism: Owning fewer, high-quality items that serve true needs.

These simple practices promote a secure and fulfilling life.

Challenges of Stealth Wealth

Although stealth wealth has many benefits, it’s not without challenges. Social pressures and cultural norms often equate success with visible wealth. Practitioners may face misunderstanding or skepticism from peers.

Another challenge is the constant temptation to indulge. In an age of consumerism, maintaining discipline requires strong willpower. However, the long-term benefits often outweigh these short-term difficulties.

Stealth Wealth in Different Cultures

Stealth wealth can be observed across various cultures. In Japan, the concept of kakeibo (household budgeting) resonates with many aspects of stealth wealth. Scandinavian countries also reflect this philosophy through their understated lifestyles and focus on social equality.

Each culture has its unique take on managing wealth. But the underlying principles of moderation and long-term planning are universal. These practices contribute to personal and communal well-being.

“`