The Complete Guide to 401(k) to IRA Rollovers: Everything You Need to Know

Rolling over a 401(k) has gotten surprisingly complicated with all the financial advice flying around. As someone who has personally executed multiple rollovers over two decades of job changes, I learned everything there is to know about this process the hard way. Today, I will share it all with you.

Your Four Options When You Leave (and Why One Is Almost Always Wrong)

When you leave a job, you basically have four choices. You can leave the money sitting in your old 401(k), roll it into your new employer’s plan, move it to an IRA, or cash it out.

Let me be blunt about that last one: cashing out is almost always a terrible idea. I watched a colleague do this after getting laid off in 2018. He thought he was getting $50,000. After taxes and the early withdrawal penalty, he took home around $32,000. The IRS gobbled up nearly 40% of his retirement savings. Don’t be that person.

Leaving money in the old plan works if the investment options are solid and the fees are low. I did this once with a former employer that had access to institutional Vanguard funds with expense ratios I couldn’t match in a regular IRA. But keeping track of multiple scattered accounts gets annoying fast.

Rolling into a new employer’s plan makes sense if your new plan is great and you want to keep everything consolidated. You also keep that ERISA creditor protection, which matters if you’re in a profession where lawsuits happen. Probably should have led with this section, honestly.

For most people, though, the IRA wins. You get access to thousands of investment options instead of whatever your employer happened to pick. Individual stocks, bonds, sector ETFs, low-cost index funds – everything’s on the table.

Direct vs. Indirect: Why This Distinction Will Save or Cost You Money

Here’s where I’ve seen people mess up badly. There are two ways to move your money: direct rollover and indirect rollover. The difference matters enormously.

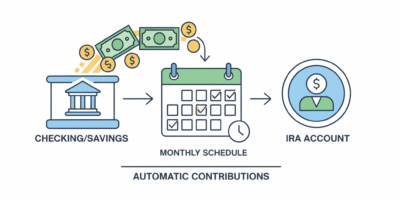

A direct rollover (also called trustee-to-trustee) means the money goes straight from your old 401(k) to your new IRA. You never touch it. The check is made payable to “Fidelity FBO [Your Name]” or whatever custodian you picked. No tax withholding. No 60-day deadline hanging over your head. This is the way.

An indirect rollover means you get the money yourself. And here’s the trap: your old plan MUST withhold 20% for taxes. So if you had $50,000, they send you a check for $40,000. But you need to deposit the full $50,000 into your IRA within 60 days – which means coming up with $10,000 from somewhere else to make up the difference. Miss that deadline or deposit less than the full amount, and you’re paying taxes and penalties on the shortfall.

I’m apparently one of those people who likes having complete control over everything, and even I use direct rollovers every time. The indirect method has too many ways to go wrong.

Oh, and the IRS only allows one indirect rollover per year across all your IRAs. Mess that up and the whole thing becomes taxable. Direct rollovers have no such limit.

How I Actually Execute a Rollover (Step by Step)

After doing this a few times, I’ve got it down to a system.

First thing: open your IRA if you don’t have one. Fidelity, Schwab, and Vanguard are all solid choices with no account fees and commission-free trades. I use Fidelity because their customer service picks up the phone quickly, but you can’t really go wrong with any of the big three.

Next, call your new IRA custodian. Tell them you want to do a direct rollover from a 401(k). Most of them will send you the paperwork AND offer to handle the back-and-forth with your old employer. Take them up on this. It’s their job and they’re good at it.

Then you need to contact your old plan administrator. HR should have the number, or it’s probably on your old statements. You’ll fill out a distribution request form and specify “direct rollover to IRA.” Make sure you have your new IRA account number ready.

Now you wait. Rollovers take anywhere from a few days to a few weeks. Government plans and smaller companies tend to be slower. Check your IRA account regularly. If nothing shows up after 3-4 weeks, start making phone calls.

Once the money arrives, it’ll probably land in a money market fund or cash sweep account. Don’t let it sit there. Figure out your investment strategy and get the money working for you.

The Tax Paperwork Nobody Warns You About

Even though direct rollovers aren’t taxable, you still get tax forms. This confuses a lot of people.

Your old employer sends you a Form 1099-R. It shows a distribution happened. Look at Box 7 for the distribution code – that tells the IRS it was a rollover, not a withdrawal. You still have to report this on your tax return, but no tax is due.

Your new IRA custodian sends Form 5498 showing the rollover contribution. Keep both forms with your tax records.

If you did an indirect rollover (again, I don’t recommend it), the 1099-R will show 20% federal withholding. You’ll need to claim that withheld amount as a tax payment when you file. The math gets messy, which is another reason direct rollovers are simpler.

Roth 401(k) Funds Need Special Handling

If you’ve been contributing to a Roth 401(k), that money has to go to a Roth IRA. You already paid taxes on those contributions, so they need to stay in the Roth universe to maintain their tax-free growth status.

Rolling Roth 401(k) money into a traditional IRA would create a mess. Don’t do it.

If your 401(k) has both pre-tax and Roth contributions, you’ll probably need to split the rollover. Pre-tax money goes to a traditional IRA, Roth money goes to a Roth IRA. Your plan administrator can help sort this out.

Company Stock: A Hidden Opportunity Most People Miss

This is one of those things financial advisors love to talk about because it sounds complicated and makes them look smart. But it’s actually worth knowing.

If your 401(k) holds appreciated company stock, something called Net Unrealized Appreciation (NUA) might apply. Instead of rolling the stock into an IRA, you take an in-kind distribution. You pay ordinary income tax on what the stock originally cost, not what it’s worth now.

When you eventually sell it, the appreciation gets taxed at long-term capital gains rates. If you’re in a high tax bracket, that could mean paying 20% instead of 37% on the gains.

This strategy has a lot of moving parts. If you have significant company stock in your 401(k), talk to a tax professional before you do anything. This is one of those rare cases where paying for advice probably saves you money.

Mistakes I’ve Seen People Make

The 60-day deadline on indirect rollovers trips people up constantly. Two months sounds like plenty of time until life happens. Stick with direct rollovers and eliminate this risk entirely.

Rolling into a high-fee IRA is another one. Before you transfer anything, compare expense ratios. A 0.5% difference might not sound like much, but compound that over 30 years and you’re talking about serious money.

People forget about old 401(k)s more often than you’d think. I’ve heard estimates that billions of dollars are sitting in forgotten accounts. Keep a master list of all your retirement accounts somewhere.

And sometimes rolling over isn’t actually the best move. Your old 401(k) might have institutional share classes with lower fees than you can get retail, or unique stable value funds earning great rates. Don’t assume an IRA is automatically better – actually compare.

When You Should Probably Get Help

Most rollovers are straightforward. But certain situations get complicated fast:

- Company stock with big unrealized gains (the NUA stuff)

- A mix of pre-tax and after-tax contributions

- Considering a Roth conversion as part of the move

- Multiple retirement accounts from various employers

A fee-only financial advisor can help navigate these situations. The keyword is “fee-only” – they get paid a flat fee or hourly rate, not commissions on products they sell you.

Bottom Line

Rolling a 401(k) to an IRA gives you more control over your investments and makes account management simpler. The key is doing a direct rollover so you don’t trigger tax headaches. Take your time, do your research, and ask questions when something doesn’t make sense. Your retirement depends on getting this right.