How to Make Your First Million

Understanding how to make your first million requires a combination of strategy, discipline, and a bit of patience. Exploring different avenues and continually educating yourself is critical in achieving this financial milestone. Here’s a comprehensive guide to help you on your journey.

Setting Clear Financial Goals

You need to establish clear financial goals. Start by determining your target amount and the timeframe in which you want to achieve it. Break down this large goal into smaller, manageable milestones. Each milestone should be specific and measurable.

Goals should address immediate, short-term, and long-term achievements. Tracking progress regularly will help adjust strategies as needed.

Creating a Detailed Budget

Regular expenses need scrutiny. List all your income sources and track your expenses. Categorize expenditures into necessities and luxuries. This habit reveals areas where you can cut back. Savings can be redirected towards investments or other wealth-building opportunities.

A budget is not a static document; it evolves with your income and financial priorities.

Investing Wisely

Investing is crucial in growing wealth. Start with understanding different investment avenues such as stocks, bonds, real estate, and mutual funds. Each has its risk and return profile. Diversify your portfolio to manage risk effectively.

Consider consulting a financial advisor to tailor an investment strategy that aligns with your risk tolerance and goals. Education on compound interest and dollar-cost averaging can maximize returns over time.

Building Multiple Income Streams

Relying on a single income source can limit your potential to accumulate wealth. Explore side hustles, freelance work, or entrepreneurial ventures. The gig economy offers various opportunities to leverage your skills and earn additional income.

Passive income streams like dividends, rental income, or royalties can significantly accelerate wealth accumulation.

Embracing the Power of Compounding

Compounding interest is a powerful tool in wealth-building. The earlier you start investing, the more time your money has to grow. Even small regular investments can grow substantially through compounding over the years.

This principle applies not only to money but also to knowledge. Invest time in acquiring new skills and knowledge that can increase your earning potential.

Smart Saving Strategies

Savings should be a priority, not an afterthought. Allocate a portion of your income to a high-interest savings account regularly. Automating savings can reduce the temptation to spend instead of save.

An emergency fund with three to six months’ worth of expenses is essential. It safeguards your investments during unexpected financial setbacks.

Expense Management

Monitoring and managing expenses is crucial. Avoid lifestyle inflation even as your income grows. Be mindful of unnecessary expenditures that detract from your savings and investment goals.

Negotiate better rates on bills and look for cost-effective alternatives without compromising your quality of life. Small savings can accumulate significantly over time.

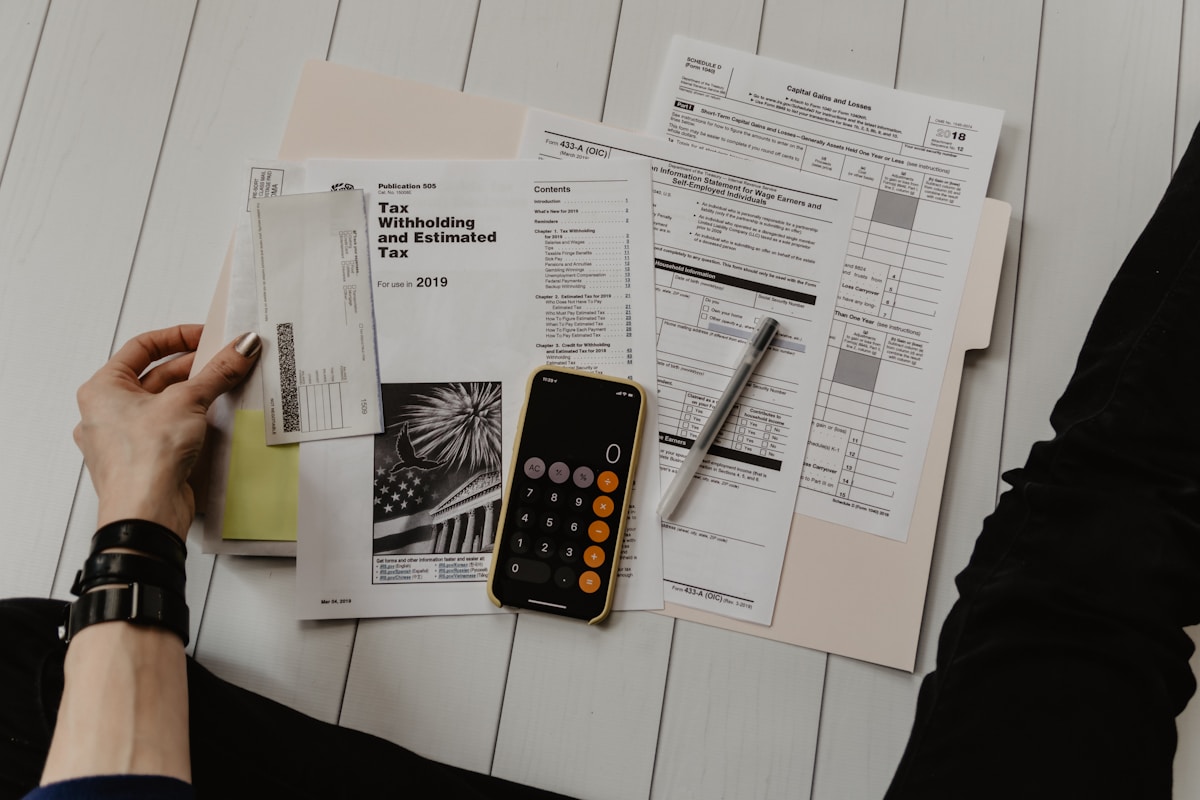

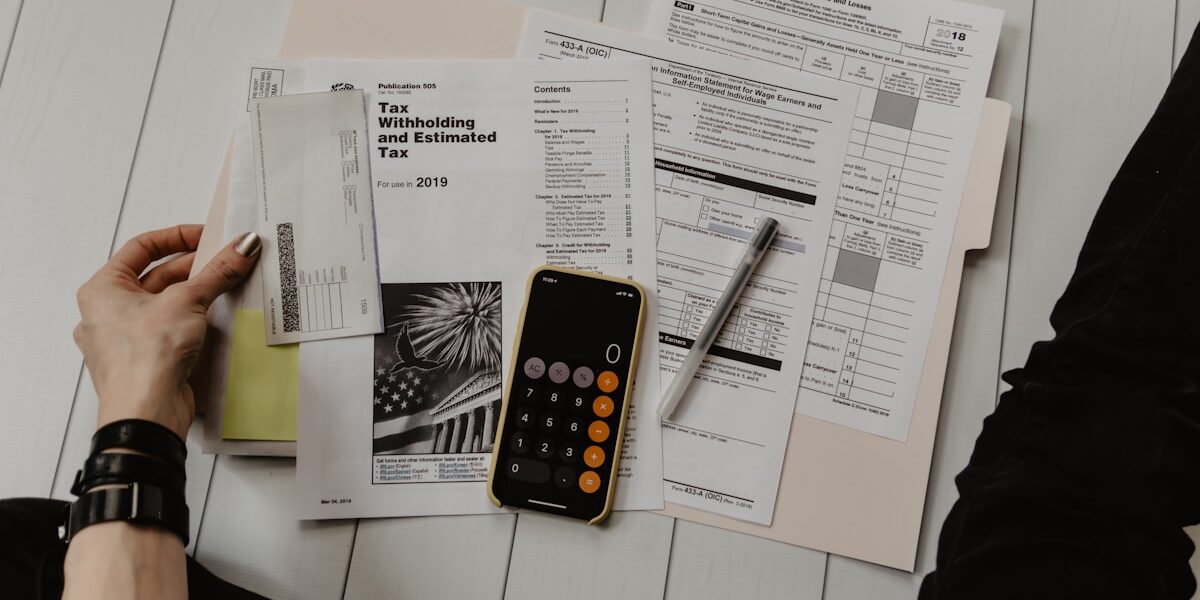

Utilizing Tax Advantages

Understanding taxes and leveraging tax-advantaged accounts can save a significant amount of money. Consider 401(k)s, IRAs, and HSAs for their tax benefits.

Consult a tax professional to optimize your tax strategy. They can help identify deductions and credits to lower your taxable income, maximizing the amount available for investment.

Networking and Mentorship

Surround yourself with like-minded individuals. Networking can open doors to new opportunities, partnerships, and insights. Learning from those who have successfully accumulated wealth provides valuable lessons and inspiration.

Seek mentors who can offer guidance and advice. Their experience can help you navigate financial challenges and make informed decisions.

Continual Education and Self-Improvement

Stay informed about financial trends, investment opportunities, and economic changes. Reading books, attending seminars, and taking courses can enhance your financial literacy.

Self-improvement extends beyond financial knowledge. Developing soft skills like discipline, perseverance, and a growth mindset contributes to long-term success.

Leveraging Technology

Financial technology offers tools to manage finances efficiently. Budgeting apps, investment platforms, and mortgage calculators can streamline your financial processes.

Blockchain and cryptocurrencies represent emerging investment opportunities. Understand their mechanisms before investing as they carry significant risks and rewards.

Avoiding Common Pitfalls

Many fail to achieve financial success due to common mistakes. Avoid high-interest debt that erodes wealth. Credit card debt, payday loans, and similar financial traps should be eliminated swiftly.

Be wary of get-rich-quick schemes. They often lead to losses and can derail your financial progress. Patience and consistent effort yield more reliable results.

Monitoring Progress and Adjusting Strategies

Regularly review your financial plan and progress towards your goals. Adjust your strategies based on financial performance and changes in your personal circumstances.

Flexibility in your approach allows you to capitalize on new opportunities and mitigate emerging risks.

Committing to Long-Term Discipline

Wealth-building requires long-term commitment and discipline. Consistent saving, investing, and spending wisely create a stable foundation. Emotional and financial resilience help maintain focus during market fluctuations and personal setbacks.

The journey to making your first million is a marathon, not a sprint. Adherence to these principles and adapting them to your unique situation can guide you to financial success.

“`

Subscribe for Updates

Get the latest articles delivered to your inbox.

We respect your privacy. Unsubscribe anytime.