How to Make Six Figures

Earning six figures has gotten complicated with all the conflicting advice flying around. As someone who’s spent years studying income growth strategies and helping people level up financially, I learned everything there is to know about hitting that six-figure mark. Today, I will share it all with you.

Here’s the truth: making $100K+ a year isn’t some impossible dream reserved for tech bros and Wall Street types. It’s doable with the right moves. Let me walk you through what actually works.

Start with a High-Income Skill

This is step one, and there’s no getting around it. You need a skill that people will pay real money for. Software development, data analysis, digital marketing, sales — these fields are growing and they pay well.

Don’t just dabble, though. Actually commit to getting good. Take courses, attend workshops, and practice until you’re genuinely skilled. Half-hearted effort gets half-hearted pay.

Build a Portfolio That Speaks for Itself

Show people what you can do. A portfolio demonstrates your expertise way better than just telling someone you’re good at something.

Include case studies and testimonials if you’ve got them. Keep it organized and easy to navigate. Highlight your best projects with clear, measurable results. If a potential client or employer can’t quickly see your value, you’ve already lost them.

Actually Network (Not Just Collect LinkedIn Connections)

Probably should have led with this section, honestly. Networking opens more doors than almost anything else. Connect with people in your industry through LinkedIn, forums, and events — but do it genuinely.

Go to conferences, webinars, and local meetups. Jump into online communities related to your field. The key here is offering value first, not just asking for things. Build real relationships and opportunities will follow.

Go After High-Paying Roles or Clients

This sounds obvious, but a lot of people stay in underpaying positions way too long. Research companies known for paying well. Target senior-level roles where six figures is the starting point, not the ceiling.

If you’re freelancing, work with businesses that value expertise and have the budget for it. Stop underpricing yourself. Know what you’re worth and charge accordingly.

Learn to Negotiate (Seriously)

Negotiation is where a lot of money gets left on the table. Before you accept any offer, look up salary benchmarks on Glassdoor or PayScale. Walk in with data, not just vibes.

Build a case for why you deserve more. Point to your skills, your track record, and specific wins you’ve delivered. Be confident but not aggressive. Most employers expect some negotiation — they’re actually surprised when people don’t.

Never Stop Learning

The market changes fast. What made you valuable two years ago might not cut it today. Stay current with trends and new technologies in your space.

Online courses, workshops, industry blogs — consume all of it. But here’s the part people miss: actually apply what you learn. Knowledge without implementation is just trivia.

Don’t Rely on One Paycheck

A single income source puts a cap on what you can earn. Side gigs, freelance work, a small business — these all add up.

Passive income is worth exploring too. Investments, royalties, digital products, online courses. Diversifying your income isn’t just about earning more; it’s about reducing risk if one stream dries up.

Consider Starting Something on the Side

A side business can seriously move the needle. Find a niche, create something people want, and sell it. E-commerce, digital products, and consulting are all solid starting points.

Use online platforms to reach people. Social media, a simple website, email marketing — these tools are accessible to everyone now. Consistency and quality matter more than a big launch.

Stay Disciplined (Even When It’s Boring)

That’s what makes the grind endearing to us long-term thinkers — the boring consistency is actually where the magic happens. Set clear goals. Track your progress. Adjust when something isn’t working.

Build a routine that keeps you productive without burning you out. Balance is real — you can’t sprint forever. But persistence over time? That’s what gets you to six figures.

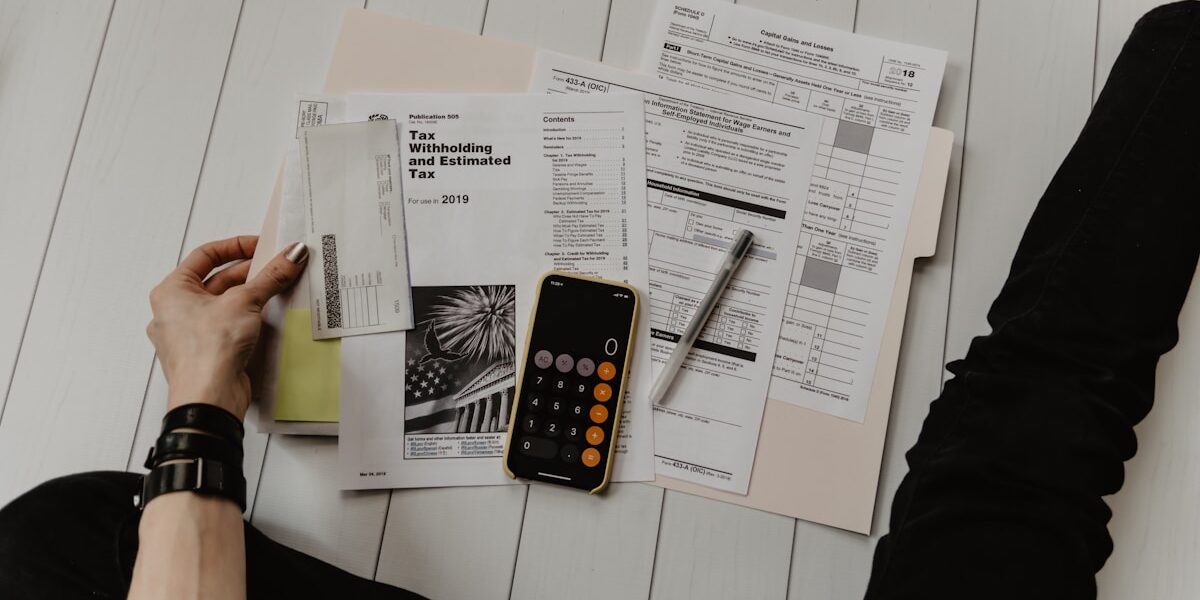

Get Your Finances in Order

Making more money doesn’t help if it all disappears. Budget, track expenses, and plan for taxes. If you’re not great with money management, talk to a financial advisor.

Invest wisely to grow what you’re earning. Understand the options, the risks, and the potential returns. A solid financial foundation turns a good income into real, lasting wealth.

Use Tech to Your Advantage

There are tools for basically everything now — productivity, finances, marketing, you name it. Use them.

Automation can handle the repetitive stuff so you can focus on work that actually moves the needle. Stay up on what’s new in your industry tech-wise. Falling behind on tools is falling behind on efficiency.

Work on Your Personal Brand

How you present yourself matters. Keep your online presence professional and consistent across platforms.

Creating content — blog posts, videos, whatever fits your style — can position you as a go-to person in your field. Engage with your audience and share stuff that’s actually useful. Thought leadership sounds corporate-y, but it works.

Find a Mentor

Having someone who’s already done what you’re trying to do? Huge advantage. They can help you skip mistakes and find shortcuts you’d never discover on your own.

Join mentorship programs or just reach out directly to people you admire. Be open to feedback, even the stuff that stings a little. That’s usually the most valuable kind.

Focus on What Actually Moves the Needle

Not all tasks are created equal. Figure out which activities have the biggest impact on your income and prioritize those. Delegate or ditch the rest.

There’s an old rule — 80% of your results come from 20% of your effort. Find that 20% and double down on it.

Keep Increasing Your Value

Find ways to deliver more than what’s expected. Understand what your clients or employer actually need and go beyond it. Creative solutions and outstanding work justify premium rates.

Keep a record of your wins. Being able to point to specific, measurable results you’ve delivered opens doors to better opportunities and higher pay.

Stay Flexible

Markets shift. Industries change. The people who keep earning well are the ones who adapt. Be willing to pivot when the situation calls for it.

Pay attention to what’s happening in your industry. New trends, new technologies, new opportunities — they’re always popping up if you’re watching for them.

Put Content Marketing to Work

Creating and sharing content about your area of expertise can attract high-paying opportunities. Blog posts, videos, social media — pick your channels and show up consistently.

Engage with people who interact with your content. Being visible and helpful online keeps you on the radar of potential clients and employers.

Go Deep in a Niche

Niche markets usually mean less competition and higher demand for specialized skills. Find one you’re genuinely interested in and know well.

Offer solutions tailored to that specific audience’s problems. Being the go-to expert in a niche beats being a generalist almost every time when it comes to earning potential.

Track Everything

Monitor your progress toward six figures. Set milestones, check in regularly, and adjust your approach based on what’s actually working.

Spreadsheets, apps, journals — whatever works for you. Looking back at your progress keeps you grounded and helps you refine your strategy over time.

Believe You Can Actually Do This

Mindset isn’t woo-woo fluff — it matters. If you don’t believe you can grow and improve, you won’t put in the effort required.

See challenges as learning opportunities. Learn from the things that don’t work out and apply those lessons next time. Staying motivated and forward-thinking is half the battle.

Stay in the loop

Get the latest wildlife research and conservation news delivered to your inbox.