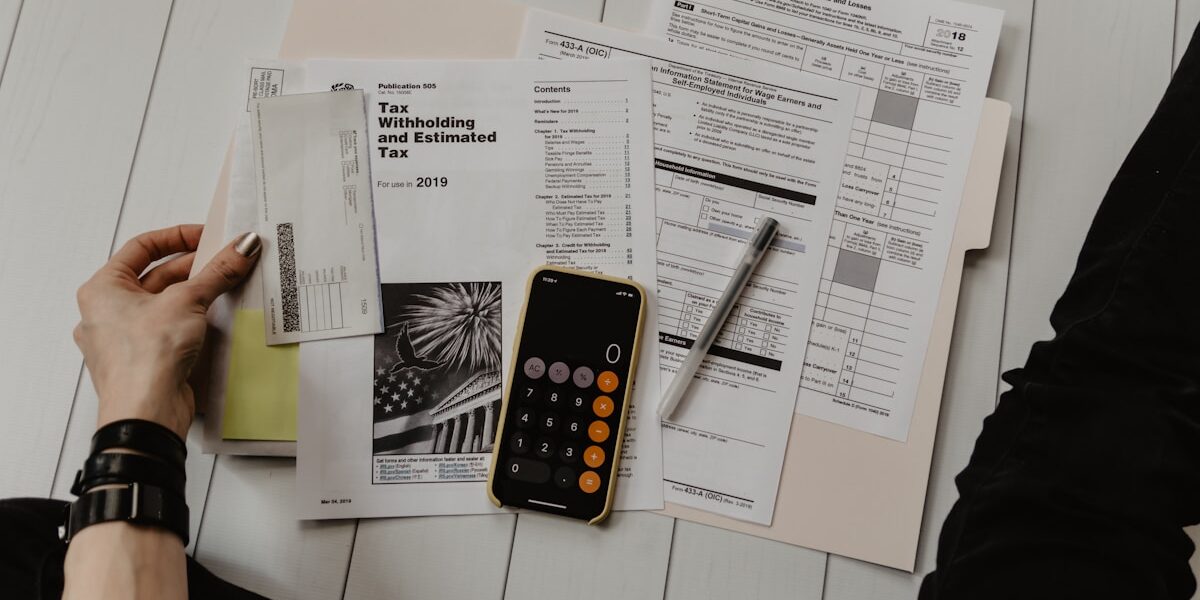

When considering the management of retirement savings, one common question that arises is whether rolling over a 401k plan is free of charge. This question is crucial for individuals transitioning between jobs, contemplating changes in their investment strategies, or looking to consolidate their retirement accounts for simplicity and better management. Here, we explore the intricacies of 401k rollovers, potential costs, and key considerations to keep in mind.

A 401k rollover typically involves transferring the funds from your current 401k plan to another retirement plan or IRA (Individual Retirement Account). This process is favored by many due to its benefits in maintaining the tax-deferred status of retirement savings and offering a broader selection of investment options.

**Understanding 401k Rollover Costs**

At its core, the act of rolling over a 401k plan itself often incurs no direct fees. Most financial institutions and plan administrators offer this service free of charge as a means to attract and retain clients. However, indirect costs can occur, depending on several factors including the type of rollover and the institutions involved.

1. **Outgoing Transfer Fees**: Some 401k plans may charge an exit or transfer fee when you move your funds to a different institution. It’s important to verify this with your current plan provider.

2. **Account Closing Fees**: If rolling over a 401k involves closing the old account, there might be a closing fee associated with it.

3. **New Account Setup Fees**: Some IRAs or new 401k plans might have setup fees that could apply when you open a new account as part of the rollover process.

4. **Investment Costs**: Different plans come with different sets of investment options and associated fees. These can include management fees, fund expense ratios, and other investment-related costs that could impact the overall cost-effectiveness of the rollover.

**Types of Rollovers and Associated Considerations**

There are two main types of 401k rollovers: direct and indirect. A direct rollover is when the funds are transferred directly from one retirement account to another. This method is generally straightforward and avoids most complications, including the mandatory 20% withholding tax that applies to indirect rollovers.

In an indirect rollover, the funds are first paid to you before being deposited into another retirement account. This method requires you to redeposit the funds into the new retirement account within 60 days to avoid taxes and potential penalties. Failure to comply with this timeframe can lead to significant tax implications and penalties, making the rollover costly.

**Best Practices for a Cost-Effective Rollover**

To ensure a smooth and cost-effective 401k rollover, consider the following tips:

– **Research and Compare Costs**: Before initiating a rollover, research different financial institutions and retirement plans. Compare their fee structures, investment options, and any potential rollover benefits or discounts they might offer.

– **Consult with Professionals**: Financial advisers can provide valuable insight into the specifics of your current plan and how best to transition your funds. They can help identify any potential fees or penalties associated with your existing account and how to avoid them.

– **Opt for a Direct Rollover**: Whenever possible, choose a direct rollover to avoid taxes and penalties that come with indirect rollovers.

– **Understand the Investment Options**: Evaluate the investment options of the new plan to ensure they align with your retirement goals and risk tolerance. This is crucial as moving to a plan with high-cost investments can erode your savings over time.

In conclusion, while a 401k rollover can often be conducted without direct fees, various indirect costs and considerations should be taken into account. By understanding these aspects and planning carefully, you can ensure that your retirement savings are transferred efficiently and affordably, preserving their value for future growth.

Leave a Reply