Financial Advisor

The first time I hired a financial advisor, I was 34, had changed jobs twice in three years, had two old 401(k)s sitting with former employers that I hadn’t touched, and had no idea what to do about any of it. I found a fee-only CFP through NAPFA, paid her a flat fee for a one-time consultation, and walked out with an actual plan. It was one of the better financial decisions I made in my thirties. But I’ve also talked to advisors since who I wouldn’t recommend to anyone — so the “how to find a good one” part really matters.

Types of Financial Advisors

The category names matter because they reflect different things about qualifications, compensation, and legal obligations:

- Certified Financial Planners (CFPs): The CFP designation requires completing a rigorous education program, passing a comprehensive exam, and meeting experience requirements. CFPs provide comprehensive financial planning — retirement, tax strategy, estate planning, insurance needs.

- Robo-advisors: Algorithm-driven platforms like Betterment and Wealthfront. They’re excellent for straightforward investment management at low cost (typically 0.25% or less annually). Limited value for complex situations.

- Investment Advisors: Focus specifically on managing investment portfolios. Often registered with the SEC or state regulators as Registered Investment Advisors (RIAs).

- Tax Advisors: CPAs with financial planning expertise, or Enrolled Agents. Particularly valuable when tax complexity is the driving need.

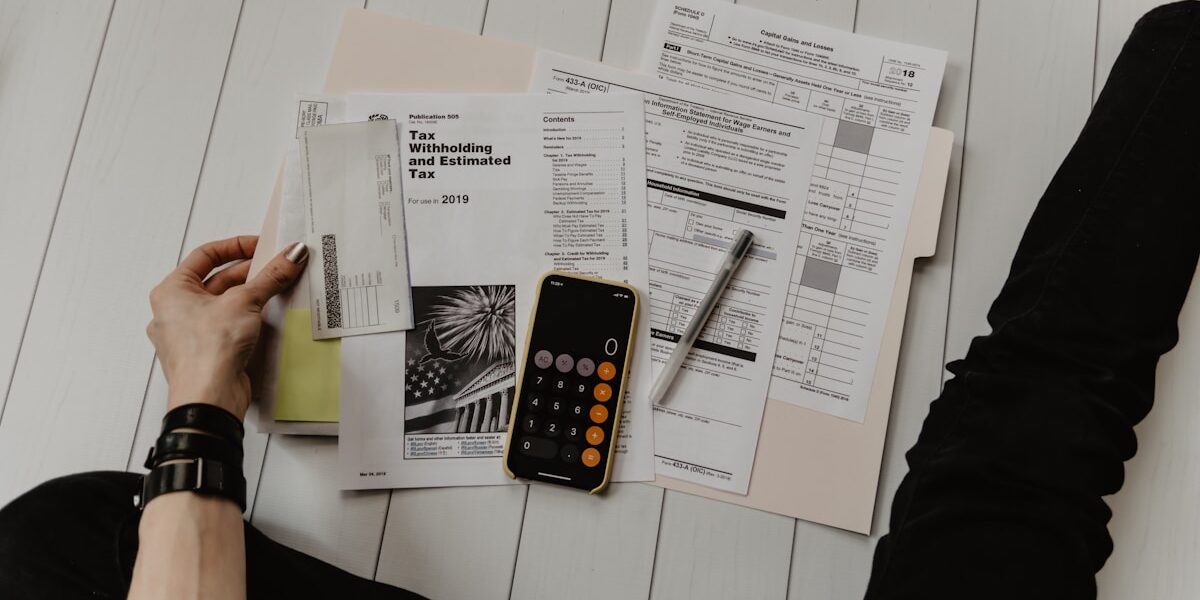

What a Financial Advisor Actually Does

Good advisors don’t just tell you what to invest in. A complete advisory relationship typically looks like this:

- Assessment: An honest audit of where you are — income, expenses, debts, assets, insurance coverage, estate documents.

- Goal Setting: Helping you define what you actually want and by when. “I want to retire at 60 with $3 million” is more useful than “I want to be financially comfortable someday.”

- Planning: Building a concrete strategy across investments, savings rate, tax efficiency, and risk management.

- Implementation: Helping you execute — which accounts to open, what to invest in, what insurance to hold.

- Monitoring: Annual (or more frequent) reviews to keep the plan aligned with your life as it changes.

When You Actually Need One

I think most people don’t need a full-service advisor for ongoing management. But there are life situations where getting professional help makes a real difference:

- Major life events: Marriage, divorce, the birth of a child, receiving an inheritance, selling a business, approaching retirement. These transitions have financial complexity that rewards planning.

- Complex investment situations: A large stock position, equity compensation from an employer, real estate holdings.

- Tax complexity: Business income, multiple income streams, large capital gains, Roth conversion decisions.

- Retirement income planning: When you shift from accumulation to distribution, the decisions get more consequential and harder to undo.

How to Choose One

The things I look for:

- Fiduciary standard: This is the most important filter. A fiduciary is legally required to act in your best interest. Non-fiduciary advisors only need to recommend “suitable” products — a much weaker standard that leaves room for recommending things that pay them more even if they’re not your best option. Ask directly: “Are you a fiduciary at all times?” and get it in writing.

- Fee structure: Fee-only advisors (paid only by you, not by commissions) have fewer conflicts of interest. Fee-based advisors can collect both fees and commissions — not necessarily bad, but less clean. Know what you’re paying and how.

- Credentials: CFP for comprehensive planning, CFA for investment management, CPA/PFS for tax-integrated planning. Verify credentials at the issuing organizations’ websites.

- Specialization: An advisor who works with retirees has different expertise than one who works with business owners or tech employees with equity comp. Find someone whose specialty matches your situation.

Getting the Most Out of the Relationship

- Bring everything — don’t hide your financial warts. The advisor can only help with what you share.

- Schedule reviews at least annually, more frequently during periods of change.

- Ask questions when you don’t understand something. A good advisor explains their reasoning; a bad one gets impatient with questions.

- Follow through on what you agree to. The plan is only worth what you actually implement.

Common Misconceptions

A few things that aren’t true:

- Financial advisors aren’t just for wealthy people. Many CFPs work with clients at various income levels, and fee-only advisors often charge flat or hourly fees that are accessible.

- Using an advisor doesn’t mean you lose control. You still make the decisions — they provide analysis and recommendations.

- One conversation isn’t financial planning. The value comes from an ongoing relationship that adjusts to your changing circumstances.

Technology’s Role

Robo-advisors have genuinely democratized investment management. If your situation is straightforward — regular contributions to a diversified portfolio, no complex tax situations — something like Betterment or Vanguard Digital Advisor can handle it at a fraction of the cost of a human advisor. Where human advisors still earn their fees is in situations requiring judgment: Roth conversion planning, tax-loss harvesting at scale, navigating a divorce, deciding whether to take a lump sum pension payout or annuity. The algorithm doesn’t do nuance well.