Understanding Tax Brackets in 2024

Tax brackets are essential for understanding how much you owe in taxes. The IRS updates these brackets annually, adjusting them for inflation. For the tax year 2024, these are the updated brackets and rates.

What are Tax Brackets?

Tax brackets group taxpayers based on income levels. Each bracket has an associated tax rate. The more income you earn, the higher the percentage you pay in taxes. However, it’s essential to know that these rates apply only to the income that falls within each bracket.

How Tax Brackets Work

Taxable income is divided into chunks based on the brackets. Each portion of your income gets taxed at the rate for its particular bracket. Only the income within each bracket gets taxed at its rate.

2024 Federal Income Tax Brackets

The tax rates for 2024 based on filing status are outlined below. These brackets apply to the taxable income of individuals. The amounts listed are the limits for each bracket.

Single Filers

- 10% on income up to $11,000

- 12% on income over $11,000 up to $44,725

- 22% on income over $44,725 up to $95,375

- 24% on income over $95,375 up to $182,100

- 32% on income over $182,100 up to $231,250

- 35% on income over $231,250 up to $578,125

- 37% on income over $578,125

Married Filing Jointly

- 10% on income up to $22,000

- 12% on income over $22,000 up to $89,450

- 22% on income over $89,450 up to $190,750

- 24% on income over $190,750 up to $364,200

- 32% on income over $364,200 up to $462,500

- 35% on income over $462,500 up to $693,750

- 37% on income over $693,750

Married Filing Separately

- 10% on income up to $11,000

- 12% on income over $11,000 up to $44,725

- 22% on income over $44,725 up to $95,375

- 24% on income over $95,375 up to $182,100

- 32% on income over $182,100 up to $231,250

- 35% on income over $231,250 up to $346,875

- 37% on income over $346,875

Head of Household

- 10% on income up to $15,700

- 12% on income over $15,700 up to $59,850

- 22% on income over $59,850 up to $95,350

- 24% on income over $95,350 up to $182,100

- 32% on income over $182,100 up to $231,250

- 35% on income over $231,250 up to $578,100

- 37% on income over $578,100

Effective Tax Rate vs. Marginal Tax Rate

It’s important to distinguish between two types of tax rates. The marginal tax rate is the rate applied to your last dollar of income, while the effective tax rate is the average rate you actually pay on all your income.

Other Considerations

Standard deductions also adjust every year. For 2024, they are:

- Single Filers: $13,850

- Married Filing Jointly: $27,700

- Head of Household: $20,800

These deductions reduce your taxable income and can change your tax liability significantly. Other deductions and credits may also apply based on specific circumstances, further lowering your tax burden.

Planning for 2024

Understanding these tax brackets can help you plan better financially. By estimating your taxable income for 2024, you can anticipate your tax liability and take steps to minimize it.

Contributions

Maximizing contributions to retirement accounts like a 401(k) or IRA can lower your taxable income. These contributions are often excluded from your taxable income, reducing the amount subject to high tax rates.

Charitable Donations

Qualifying donations to charitable organizations can also reduce your taxable income. Keeping records of these contributions is essential for ensuring you can claim these deductions.

Tax Credits

Tax credits directly reduce the amount of tax you owe. Investigate credits for which you may be eligible, such as the Child Tax Credit or the Earned Income Tax Credit.

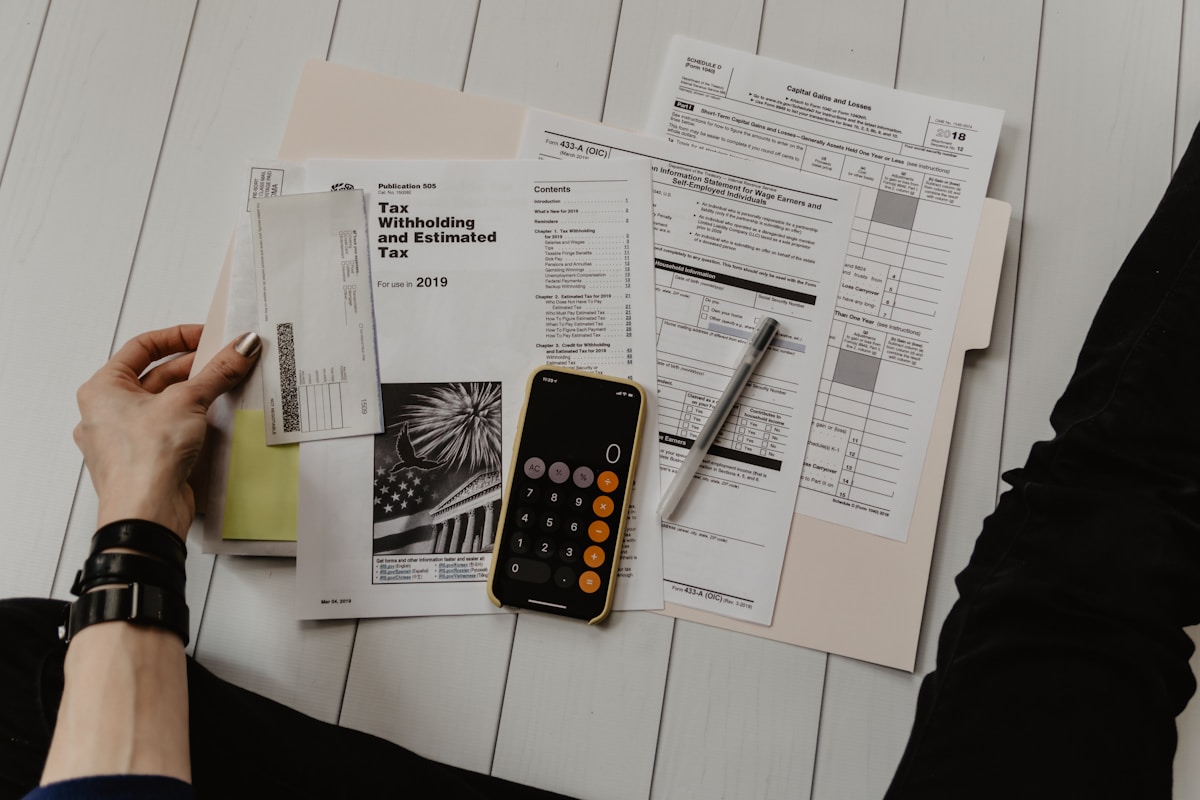

Tax Software and Professional Help

Consider using tax software or consulting a tax professional. These resources can help you navigate the complexities of the tax code, ensuring you’re taking full advantage of all deductions and credits available.

Tax Bracket Creep

Over time, inflation can push taxpayers into higher tax brackets, a phenomenon known as bracket creep. While the IRS adjusts brackets for inflation annually, wage growth can sometimes outpace these adjustments, increasing tax liabilities.

Stay Informed

Tax laws and brackets can change based on legislation. Staying informed about these changes can help you adapt your financial planning accordingly. Keep an eye on updates from the IRS and other reliable sources.

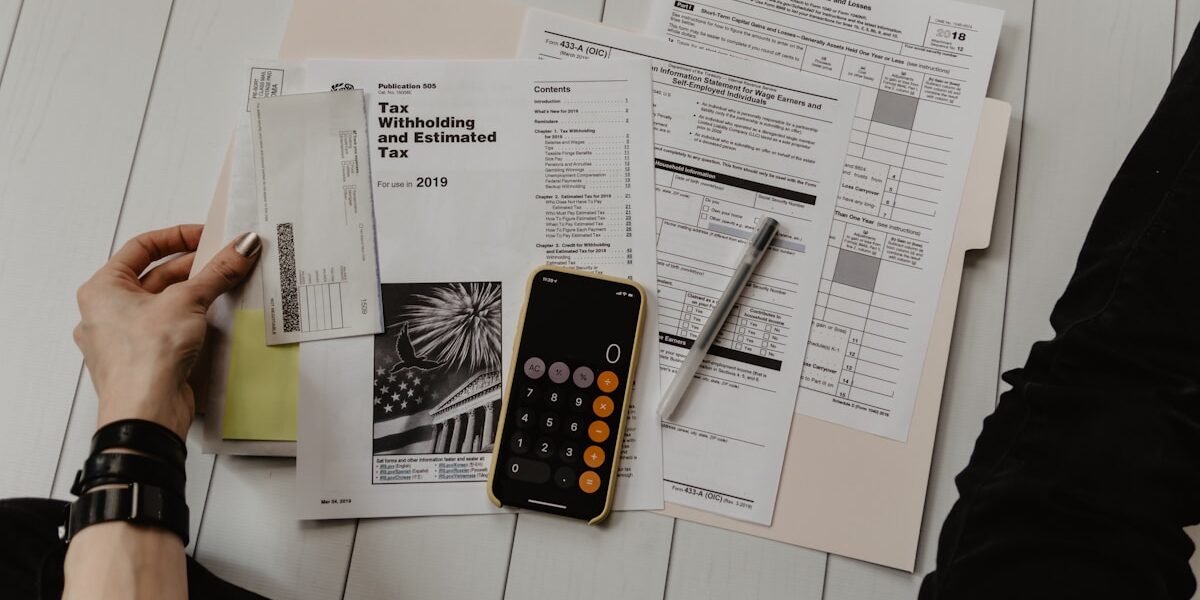

Keeping your tax documents organized throughout the year can simplify the filing process. Maintain records of income, deductions, and credits to ensure a smooth and accurate tax filing experience.

2024 Tax Filing Season Tips

Mark important dates on your calendar. For most taxpayers, the filing deadline is April 15. However, certain circumstances may allow for extended deadlines. Filing early can help avoid the last-minute rush and potential delays.

Double-check your return for accuracy before submission. Errors can delay processing and result in additional scrutiny from the IRS.

Finally, consider your method of payment if you owe taxes. Options include direct debit, credit card payments, or setting up a payment plan if needed.