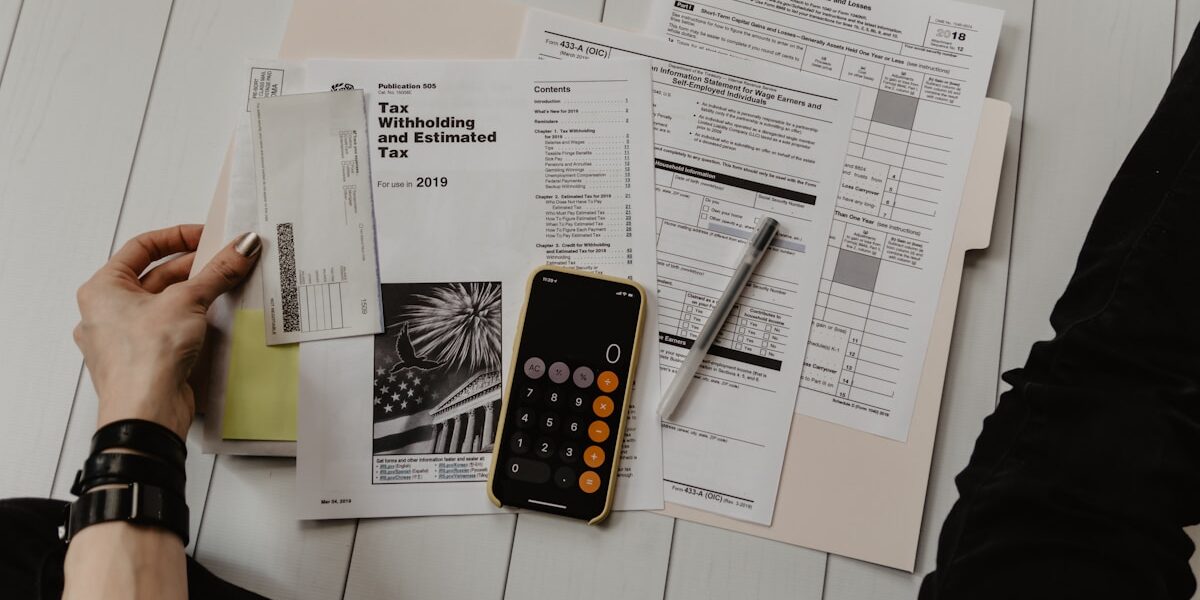

Navigating the world of retirement accounts can be tricky, especially when it comes to managing rollovers. One common question among those shifting their retirement funds is about the time limit associated with a 401k rollover. Understanding this timeline is crucial to avoid potential taxes and penalties that can impact your retirement savings.

A 401k rollover involves moving funds from a 401k plan, often due to a job change or retirement, into another retirement account such as an IRA or a new employer’s 401k plan. The primary reasons for a rollover are to maintain the tax-deferred status of retirement savings and to consolidate funds for easier management and potentially better investment options.

The IRS stipulates a 60-day rollover rule for 401k plans. This rule states that once funds are distributed from your original 401k, you have 60 days to deposit them into another qualifying retirement plan or IRA. If you fail to complete the rollover within this 60-day period, the distributed amount may be treated as taxable income for the year in which the distribution occurred. Additionally, if you are under the age of 59.5, a 10% early withdrawal penalty could apply.

It’s important to note that the 60-day period begins the day after you receive the distribution. Therefore, it’s crucial to act promptly and ensure that your funds are deposited into the new plan within this timeframe to avoid unwanted taxes and penalties.

There are some exceptions to the 60-day rule. For instance, if you encounter a disaster or other events that the IRS recognizes as a valid reason for delay, you may be granted an extension. Such extensions are rare and usually require substantial proof of hardship.

Another critical point to consider is the direct rollover option. A direct rollover from your old 401k to the new retirement account is often the safest approach to avoid accidentally missing the 60-day deadline. With a direct rollover, funds are transferred directly between financial institutions, and you never take possession of the money. This method not only simplifies the process but also eliminates the risk of the distribution being counted as taxable income.

If you find yourself unsure about how to proceed with a 401k rollover or if you’re nearing the end of the 60-day period, it’s wise to consult with a financial advisor or tax professional. They can provide guidance specific to your situation, which can help in making informed decisions that protect your retirement assets.

In summary, while the 60-day rule is a critical guideline for 401k rollovers, understanding your options and the rules can help ensure that your retirement funds continue to grow, untaxed, until you need them. Always consider a direct rollover to simplify the process and consult a professional if you encounter any issues or have questions.

Leave a Reply